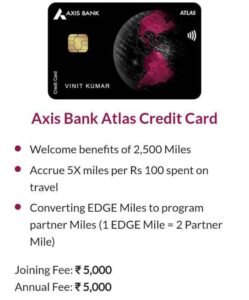

Detailed review of the Axis Bank Atlas Credit Card. Learn about fees, lounge access, EDGE Miles rewards, 1:2 transfer ratio to 20+ travel partners, and how to earn up to 20% returns on travel spends.

Axis Bank Atlas Credit Card Review – A Premium Travel Card for Frequent Flyers

If you are a travel enthusiast looking for a high–value credit card, the Axis Bank Atlas Credit Card is one of the most rewarding options in India. Designed specifically for travelers, this card offers accelerated EDGE Miles on travel spends, a unique 1:2 transfer ratio to 20+ airline and hotel partners, and premium lifestyle benefits like lounge access. Let’s dive into the details.

Fees & Charges

- Joining & Renewal Fee: ₹5,000 + GST

- Welcome Benefit: 2,500 EDGE Miles on first transaction within 30 days

- Renewal Benefit: Additional EDGE Miles (based on tier level)

Tier Structure – Silver, Gold & Platinum

The Atlas Card uses a tier-based rewards model similar to hotel loyalty programs:

- Silver Tier (Default): No renewal EDGE Miles

- Gold Tier: Achieved with ₹7.5L annual spend; 2,500 renewal EDGE Miles

- Platinum Tier: Achieved with ₹15L annual spend; 5,000 renewal EDGE Miles

⚠️ Note: Tier status is reviewed every membership year. If you don’t meet the spend criteria, you will be downgraded.

Lounge Benefits

Lounge access depends on your tier level:

- Silver: 8 Domestic + 4 International visits per year

- Gold: 12 Domestic + 6 International visits per year

- Platinum: 18 Domestic + 12 International visits per year

Guests can also use your allocated visits, but it counts towards your quota.

Lifestyle Perks

- Dining Benefits: 25% discount (up to ₹800 twice per month) on EazyDiner with a minimum order of ₹2,000.

Milestone Benefits

- Spend ₹3L annually → 2,500 EDGE Miles

- Spend ₹7.5L annually → Extra 2,500 EDGE Miles

- Spend ₹15L annually → Extra 5,000 EDGE Miles

⚠️ Exclusions: Rent payments, fuel, utilities, government transactions, jewelry, and insurance don’t count towards milestones.

Rewards Structure

- Base Reward: 2 EDGE Miles per ₹100 spent

- Travel Spends (Direct Airline & Hotel bookings): 5 EDGE Miles per ₹100 spent

- Travel Aggregators (MakeMyTrip, Goibibo, etc.): Only 2 EDGE Miles per ₹100

💡 Monthly travel spend cap: Only up to ₹1L earns accelerated 5 Miles/₹100; beyond that, 2 Miles/₹100.

Redemption Options

- Axis Travel Edge Portal – 1 EDGE Mile = ₹1 (flights & hotels)

- Transfer to Travel Partners – 1 EDGE Mile = 2 partner miles/points (except Marriott Bonvoy)

Popular partners include Air Canada, Air France, Qatar Airways, Singapore Airlines, ITC Hotels, IHG, and Accor Hotels.

⚠️ Restrictions:

- Max 1.5 lakh EDGE Miles transferable per year

- Group A Partners: 30,000 EDGE Miles cap

- Group B Partners: 1,20,000 EDGE Miles cap

Example: How to Earn 20%+ Returns

Let’s assume:

- Annual spend = ₹3L (Silver Tier)

- You earn:

- 2,000 EDGE Miles (base spend of ₹1L)

- 10,000 EDGE Miles (₹2L travel spend at 5x)

- 2,500 Welcome Miles

- 2,500 Milestone Miles

- Total = 17,000 EDGE Miles

When transferred at 1:2 ratio to Accor Hotels, these become 34,000 points, worth ~₹61,200.

- Effective Return = 20.97% on ₹3L spend

This makes the Axis Bank Atlas one of the highest rewarding credit cards for savvy travelers.

Drawbacks

- High forex markup of 3.5%, not ideal for direct international usage

- No renewal fee waiver option

- Tier downgrade risk if annual spend drops

- Key travel benefits like airport transfer & meet-and-greet have been discontinued

Final Verdict

The Axis Bank Atlas Credit Card is best suited for frequent travelers who understand airline miles and hotel loyalty programs. If you redeem points smartly by transferring to partners, you can unlock 10–20%+ value on your spends. However, if you prefer straightforward cashback or simple rewards, this card may not be the right fit.

👉 Recommended for: Miles enthusiasts, frequent flyers, luxury travelers