Read our detailed Axis Bank Select Credit Card review 2025. Discover fees, rewards, travel perks, dining benefits, and whether this lifestyle credit card is right for you.

Axis Bank Select Credit Card Review – Benefits, Rewards & Travel Perks

If you’re looking for an all-rounder credit card that offers benefits across offline shopping, groceries, dining, and travel, the Axis Bank Select Credit Card is worth considering. Unlike many cards that focus primarily on online spends, this card gives accelerated rewards on offline retail transactions, making it a valuable option for those who prefer store shopping.

In this review, we’ll break down the key features, benefits, and drawbacks of the Axis Bank Select Credit Card to help you decide if it matches your lifestyle.

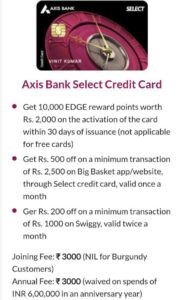

Fees & Charges

- Joining & Annual Fee: ₹3,000

- Fee Waiver: Annual fee waived on yearly spends of ₹8,00,000

- Special Offer: Axis Burgundy clients get the card lifetime free

- Welcome Bonus: 1,000 Reward Points (worth ₹2,000) on first transaction within 30 days of issuance

Reward Points Structure

- 2X Rewards (20 points) per ₹200 spent on retail transactions (offline spends)

- 10 Reward Points per ₹200 on all other spends

- Reward Value: 1 point = ₹0.20 (when redeemed via catalog)

Redemption Options

- Redeem points via catalog, partner air miles, and hotel loyalty programs

- Conversion Ratio:

- Standard: 10:1 (low value)

- Best brands (Club ITC, Spice Club, AirAsia): 5:1

- Cap: 5 lakh points per year for transfers (1 lakh with Group A, 4 lakh with Group B partners)

⚠️ Drawback: Redemption value is relatively low compared to premium travel cards.

Dining & Grocery Benefits

- BigBasket: Flat ₹500 off per month on spends of ₹3,000+

- Swiggy: Save up to ₹400 per month on orders worth ₹1,000+

- Axis Dining Delights program offers additional restaurant discounts

Travel Benefits

- International Lounge Access:

- 6 complimentary visits per year (with Priority Pass, free for first year)

- Additional 6 visits + Priority Pass renewal on annual spends of ₹3,00,000

- Domestic Lounge Access: 2 complimentary visits per quarter (on spends of ₹50,000 per quarter)

- Golf Benefits: Up to 12 complimentary golf games/lessons per year

Milestone Benefits

- Earn 5,000 bonus Reward Points every year on annual spends of ₹3,00,000

Additional Benefits

- 1% fuel surcharge waiver

- Complimentary Priority Pass (first year, renewable with milestone spend)

- Lifestyle discounts through partner merchants

Who Should Get the Axis Bank Select Credit Card?

The Axis Bank Select Credit Card is ideal for:

- Shoppers who spend heavily on offline retail transactions

- Families who frequently use BigBasket and Swiggy

- Frequent travelers who want lounge access and golf privileges

However, if your focus is maximizing air miles and high-value redemptions, you may find better options in premium travel credit cards

Final Verdict

The Axis Bank Select Credit Card is a well-balanced lifestyle card that offers strong offline rewards, daily-use discounts, and solid travel benefits. Its biggest drawback is the low redemption value of reward points, but if you’re someone who spends more on groceries, dining, and retail purchases, this card can still deliver great value.

Read our detailed Axis Bank Select Credit Card review 2025. Discover fees, rewards, travel perks, dining benefits, and whether this lifestyle credit card is right for you.

⭐ Rating: 4/5