Read the latest Flipkart Axis Bank Credit Card review 2025. Know updated cashback benefits, fees, charges, eligibility, and whether it’s still worth applying after recent devaluation.

Flipkart Axis Bank Credit Card Review 2025 – Features, Fees, Cashback & Latest Changes

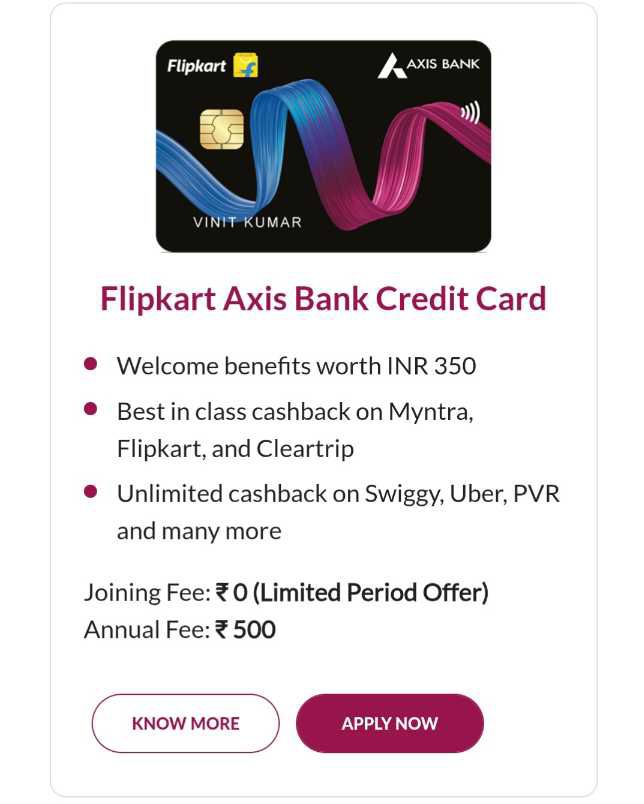

The Flipkart Axis Bank Credit Card is one of the most popular shopping credit cards in India. When it was launched, it offered unlimited cashback and several premium benefits, but over time, Axis Bank has devalued this card by putting caps on cashback and adding new charges.

In this article, we’ll cover the latest benefits, cashback structure, fees & charges, eligibility criteria, and whether the Flipkart Axis Bank Credit Card is still worth it in 2025.

Welcome Benefits

- ₹250 Flipkart Gift Voucher on completing the first transaction.

- 50% off on Swiggy (up to ₹100) on the first transaction using coupon code

AXISFKNEW.

Cashback & Rewards Structure

- 7.5% Cashback on Myntra (capped at ₹4,000 per quarter).

- 5% Cashback on Flipkart & Cleartrip (capped at ₹4,000 per quarter).

- 4% Unlimited Cashback on Swiggy, Uber, PVR, CultFit.

- 1% Unlimited Cashback on all other spends.

⚠️ No Cashback on: Utility bills, telecom, education, rent, wallet load, government services, insurance, gold purchases, fuel, and certain other transactions.

Fees & Charges

- Joining Fee: ₹500 + GST (₹590). Currently First Year Free.

- Annual Fee: ₹500 + GST (waived if annual spends exceed ₹3.5 lakh).

- Finance Charges: 3.75% per month (up to 45% per annum).

- Cash Withdrawal Fee: 2.5% (minimum ₹500).

- Foreign Transaction Fee: 3.5%.

- Late Payment Fee: Up to ₹1,200 depending on due amount.

- Over-limit Fee: 2.5% (minimum ₹500).

Additional Benefits

- Fuel Surcharge Waiver: 1% on transactions between ₹400–₹4,000 (max ₹400 per statement cycle).

- Dining Delights: Up to 15–20% discount at partner restaurants.

- EMI Option: Available on Flipkart purchases above ₹1,500.

- Wednesday Offers: Up to 15% off on Goibibo, MakeMyTrip, Swiggy, Amazon Fresh & Tata Neu.

Eligibility Criteria

- Minimum Age: 18 years.

- Income: ₹10,000–15,000 monthly is usually enough to qualify.

- CIBIL Score: 730+ recommended (though approvals may happen even at 735–740).

Recent Devaluation – Is It Still Worth It?

Earlier, the Flipkart Axis Bank Credit Card offered unlimited 5% cashback on Flipkart purchases. Now, cashback is capped at ₹4,000 per quarter, which means a maximum of ₹16,000 cashback annually on Flipkart.

Considering the annual fee of ₹590, the card still offers great value for Flipkart and Myntra shoppers, especially since the first year is free.

However, if you want unlimited cashback, the SBI Cashback Credit Card might be a better choice as it offers 5% unlimited cashback on online spends.

Final Verdict

The Flipkart Axis Bank Credit Card (2025) is still a strong option for frequent Flipkart and Myntra users, despite recent devaluations. With a first-year free offer, welcome vouchers, and good partner discounts, it remains one of the best shopping credit cards in India.

But if your priority is unlimited cashback without restrictions, you may want to explore alternatives like the SBI Cashback Credit Card.