Complete review of the IndianOil Axis Bank Premium Credit Card 2024. Explore fees, rewards, lounge access, fuel benefits, redemption options & best ways to maximize value.

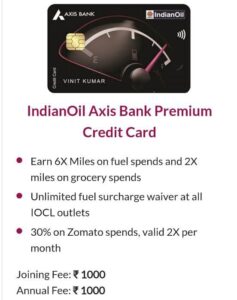

IndianOil Axis Bank Premium Credit Card Review 2024

The IndianOil Axis Bank Premium Credit Card is a mid-tier lifestyle and fuel-focused credit card designed for those who spend frequently on fuel and travel. Originally launched under Citi Bank, this card is now offered by Axis Bank with updated benefits and features.

Fees & Charges

- Joining & Renewal Fee: ₹1,000 + taxes

- Annual Fee Waiver: Spend ₹1,00,000 in a year to get renewal fee waived (rent, wallet loads, and insurance payments are excluded).

- Earlier, under Citi Bank, spending ₹30,000 was enough for a waiver.

Welcome Benefits

- 500 EDGE Miles on first transaction within 30 days of card issuance.

- Only applicable for customers who applied after July 1, 2024.

- Not available for existing Citi-to-Axis migrated cardholders.

Lifestyle Benefits

- Airport Lounge Access: 2 complimentary domestic lounge visits per quarter.

- Condition: Minimum ₹50,000 spend in the last 3 months.

- This is a new addition compared to Citi Bank’s earlier version, which had no lounge benefit.

Reward Structure

- Base Rewards: 1 EDGE Mile per ₹100 spent (excludes utilities, rent, wallets, insurance, EMI, government payments, and fuel surcharge).

- Fuel Spending (IndianOil Pumps): 6X EDGE Miles (per ₹150 spent), capped at ₹15,000 fuel spends per statement cycle.

- Grocery & Supermarkets: 2X EDGE Miles per ₹150 spent.

Redemption Options

- Travel Partners – Transfer EDGE Miles to leading airlines & hotels.

- Group A (Max 1,00,000 miles/year): Air Canada, Etihad, Singapore Airlines, Qatar Airways, United, Marriott, Wyndham, etc.

- Group B (Max 4,00,000 miles/year): Air India, Vistara, Air Asia, SpiceJet, ITC Hotels, Qantas, etc.

- Fuel Redemption (IOCL Extra Rewards) –

- 3 EDGE Miles = 10 IOCL Extra Rewards Points.

- 1 Extra Reward = ₹0.30 (30 paise).

- Effective return: 4% on fuel spends.

Rewards Value Analysis

- Normal Spends: Low return, not suitable for everyday use.

- Grocery Spends: Below-average returns compared to other credit cards.

- Fuel Spends: Best use case. You can earn ~4% return when redeeming for IndianOil fuel.

Pros & Cons

Pros ✅

- Good for fuel users with ~4% return.

- Complimentary lounge access (conditional).

- Wide range of airline & hotel transfer partners.

Cons ❌

- High annual spend required for fee waiver.

- Poor value on normal and grocery spends.

- Redemption limits on EDGE Miles transfers.

Final Verdict

The IndianOil Axis Bank Premium Credit Card is most suitable for users who spend regularly on fuel at IndianOil outlets and want the flexibility to redeem points for travel partners or fuel. However, for general spending, the rewards rate is not competitive compared to other mid-tier cards.

Rating: 3/5 – Best for fuel-focused cardholders, but not ideal as a primary credit card for overall spending.